tempe az sales tax calculator

A Transaction Privilege TaxTPT or sales tax license may be required for your business activity in Tempe. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Location Based Reporting Arizona Department Of Revenue

Within Tempe there are around 7 zip codes with the most populous zip code being 85281.

. The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. The average cumulative sales tax rate in Tempe Arizona is 81. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona. Tempe Tax License is responsible for issuing liquor licenses licenses for regulated businesses and ensuring compliance of Transaction Privilege Tax. US Sales Tax Rates AZ Rates Sales Tax Calculator Sales Tax Table.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Click The Logo Below To View The Model City Tax Code. The minimum combined 2022 sales tax rate for Tempe Arizona is.

Subject to Transaction Privilege TaxTPT or sales tax an alternative to hotels and motels but taxed the same commonly advertised on an online marketplace for lodging. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ. Tempe is located within Maricopa County Arizona.

SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. The current total local sales tax rate in Tempe Junction AZ is 6300. What is the sales tax rate in Tempe Arizona.

Arizona has a 56 statewide sales tax rate but also has 99 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 241 on top of. You can now choose the number of locations within Arizona that you would like to compare the Sales Tax for the product or service amount you entered. Sales tax in Tempe Arizona is currently 81.

ICalculator US Excellent Free Online Calculators for Personal and Business use. 85280 85281 85282. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

After choosing the number os Locations to compare a list of. City Hall 31 E. Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality.

Download all Arizona sales tax rates by zip. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Tempe Sales Tax Rates for 2022.

5th St Tempe AZ 85281 P. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License. City Hall 31 E.

5th St Tempe AZ 85281. City Hall 31 E. The Tempe Arizona Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Tempe Arizona in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Tempe Arizona.

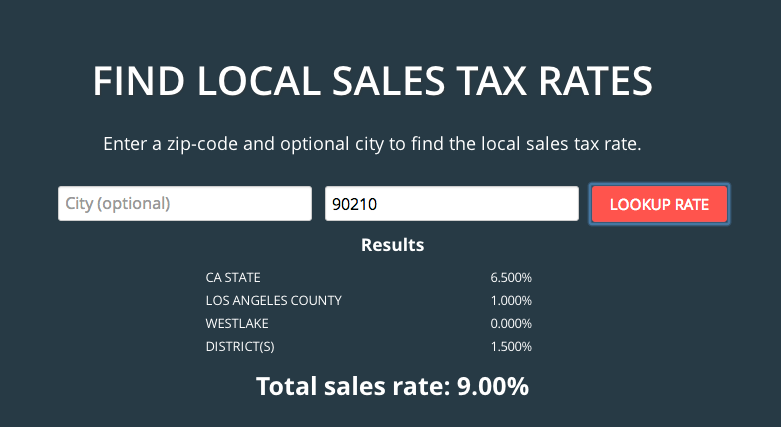

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. The Tempe Arizona sales tax rate of 81 applies to the following seven zip codes.

City Hall 31 E. Groceries are exempt from the Tempe and Arizona state sales taxes. Method to calculate Tempe Cascade sales tax in 2021.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. This includes the rates on the state county city and special levels. The current total local sales tax rate in Tempe AZ is 8100.

The December 2020 total local sales tax rate was also 6300. The December 2020 total local sales tax rate was also 8100. Avalara provides supported pre-built integration.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Apply or Renew on the Accela Citizen AccessACA Portal. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

The sales tax rate does not vary based on zip code. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. Tempe AZ 85280 salestaxtempegov.

You can find more tax rates and allowances for Tempe and Arizona in the 2022 Arizona Tax Tables. Apply File Pay Transaction Privilege Tax TPT or sales tax at AZTaxesgov. Sales Tax Calculator Sales Tax Table.

AZ is in Maricopa County. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state.

This is the total of state county and city sales tax rates. The average sales tax rate in Arizona is 7695. What Businesses Are Taxable And At What Tax Rate.

Residential Commercial Rentals City Of Tempe Az

How To Collect Sales Tax Through Square Taxjar

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Income Tax Calculator Smartasset

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Reverse Sales Tax Calculator Dremployee

Arizona Sales Tax Small Business Guide Truic

Tax Brackets 2019 Tax Brackets Bracket Tax

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Sales Tax Small Business Guide Truic